In the Las Vegas Valley, it was anything but difficult to get calmed into lack of concern constantly 50% of 2020 when it came to contract rates. Indeed, even as different markers said rates ought to be increasing, they proceeded on a quiet excursion to numerous record lows. 2021 has been altogether different up until this point!

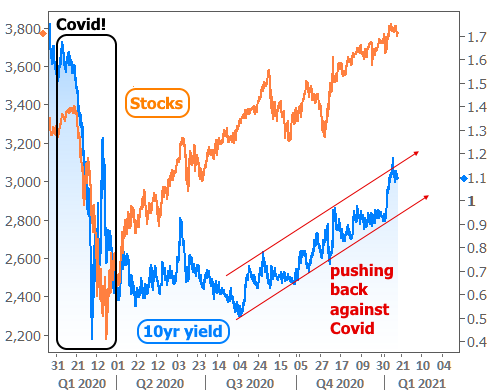

Coronavirus and its effects on the economy remain the main thrusts behind market patterns. That is for the most part been extraordinary for rates, yet it additionally implies that rates ought to progressively increase as we fight back against Coronavirus. On the off chance that the beginning of the pandemic pushed rates to unequaled lows, it’s quite reasonable that progress against the pandemic would bring about rates climbing from record-breaking lows.

On the off chance that you ask 10yr Treasury yields, that has been the situation for a long time.

And keeping in mind that the securities exchange has been singing a comparable tune, the home loan market has been in its own sublime world with rates apparently careless in regards to Treasury patterns.

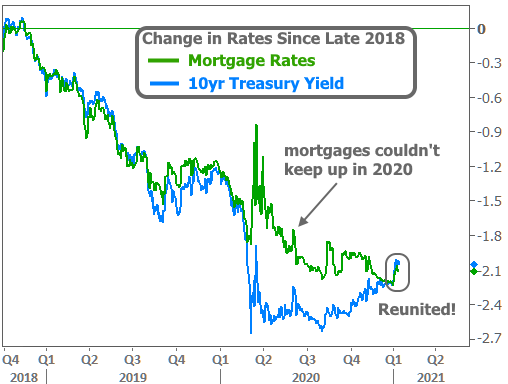

Home loan rates and Treasuries ordinarily follow each other in close to bolt step. There are outstanding special cases, yet none have been as articulated as 2020. Home loans basically couldn’t stay aware of Treasuries in transit down. That left them with a pad to retain practically the entirety of that “push back” found in the graph above.

As such, that pad permitted contract rates to move sideways or lower for quite a long time, even as Treasury yields moved higher. We’ve cautioned consistently that this was progressively liable to change. A week ago, it at last did.

In spite of the fact that there’s actually still some pad left, it’s presently too little to even think about soaking up greater occurrences of unpredictability in Treasuries.

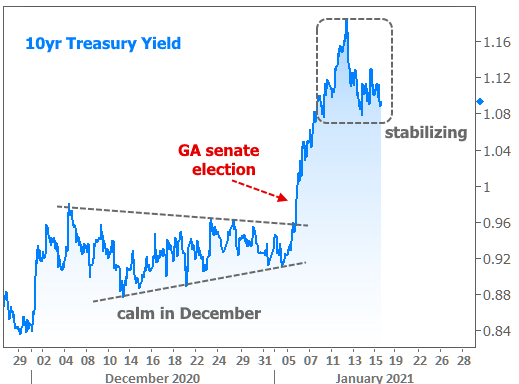

As a week ago’s bulletin talked about (get made up for lost time here), the Georgia senate political decision brought about one of the most honed loan cost spikes of the previous few years. In truth, that is a genuinely low bar to clear when rates have been doing so well throughout that time, however it regardless raised worries about where we might be going straightaway.

At the point when rates rise this rapidly, merchants are keeping watch for extra shortcoming (and a chance to discover a roof). That was the primary thing to address this week. Nobody needed to be the first to discover that falling blade (large moves like this can make force that goes on for quite a long time/weeks, and dealers can get copied in the event that they wager on a bounce back excessively fast), however chances started to die down on Tuesday evening after a solid 10yr Treasury sell off. Securities didn’t freeze again for the remainder of the week, having the master plan impression that the mid 2021 rate spike has settled.

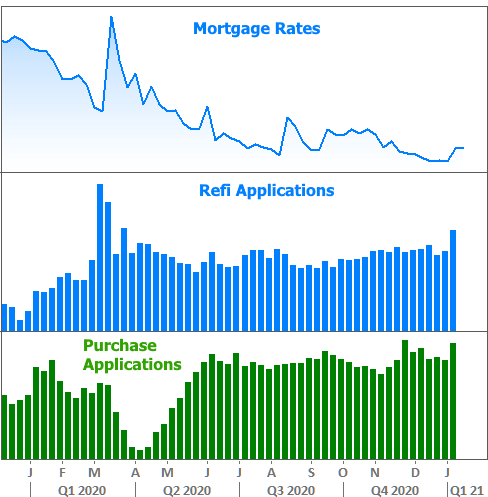

You may have seen other news features that propose it was an awful week for contract rates. It wasn’t. That was LAST week. The features being referred to depend on old data. By Friday evening, the normal moneylender was offering rates that were in any event as low as those seen last Friday.

The issue has to do with a mainstream week by week rate overview from industry monster Freddie Mac. The study makes a fine showing catching general terms after some time, yet is seriously restricted with regards to convenient everyday changes. To put it plainly, the study is a few seconds ago catching LAST WEEK’S rate spike. Here’s the manner by which every day rates have been moving by examination (note: the green line is somewhat higher on the grounds that it incorporates renegotiates. Freddie simply asks advance officials for their “best” rate, and in this market, that is consistently buys).

Talking about buys and refis, the current week’s home loan application information was fascinating. While you may expect a major rate spike to prevent refi request (and as a rule, you’d be correct), a week ago’s rate spike persuaded property holders to get off the fence. The check of refi applications was the most noteworthy it’s been since the 2 greatest weeks toward the beginning of the pandemic.

One week from now brings extra lodging market information beginning on Wednesday with one more gander at contract applications and another report on manufacturer certainty. Extra development and deals information will be accounted for on Thursday and Friday. Bonds (and most home loan banks) will be shut on Monday in recognition of Martin Luther King Jr. Day.