Purchasing a home can be intimidating. Whether it’s your first home purchase or your fifth, the entire experience can be confusing, overwhelming, yet exciting. Between the paperwork, legalities and the commitment that a buyer has to sign on to, the process can be daunting. One common misconception is that as a buyer you need to save a tremendous amount to get into your new home. That’s not always the case. There are tons of different programs out there to assist you in getting the keys to your new palace.

How much do you need to save for your new home?

Having a savings and being prepared is always a good idea. Aside from your typical moving expenses which could run you a couple thousand dollars, here is an example of some of the options that might be available to you:

Fannie Mae / Freddie Mac Conventional Loans: These conventional loans were created by Congress and play an important role in the nation’s housing finance system. Their entire purpose is to provide liquidity, stability and affordability to the mortgage market. These loans can be available to you with down payments as low as 5% of your purchase price. With this type of loan, the minimum will change based on the property type, your credit score and a few other factors.

The FHA Loan Program: The FHA loan program has been helping people become homeowners since 1934. FHA stands for Federal Housing Administration and it offers insurance on a loan so that your lender can offer you a better deal. The FHA offers down payments as low as 3.5% of your purchase price, low closing costs, easy credit qualifying, financial help for seniors and more. If you have less to put down towards your home or a less than perfect credit score, the FHA loan program might be best for you.

HomePath by Fannie Mae: Fannie Mae offers another program called “HomePath” which allows some borrowers to fund their down payment through other government agencies, gifts, grands, employers, or even unsecured loans from family.

U.S. Department of Veterans Affairs and U.S. Department of Agriculture: Both the VA and the USDA offer loan programs for individuals and / or properties that meet their criteria. If you qualify, you may be able to put ZERO down, requiring little or no cash out of pocket.

Steps you should take before purchasing a new home.

Now that you understand assistance is available to you, there are a few steps we recommend you take before starting the process.

- If you know that you plan on purchasing a home, start saving! A good starting point would be to have 4-6 month’s income saved up before starting the process. The more the better.

- Figure out what you can afford. As a rule of thumb, you want to try and keep your monthly home payment around 30% of your total (combined) monthly income. Be sure to look at your debt-to-income ratio and never over extend yourself. Use free online mortgage rate calculators to try and estimate your payments.

- Don’t forget closing costs. Regardless of your loan source, you’ll also need money to pay closing costs. You can estimate your state average closing cost with Bankrate’s closing costs map.

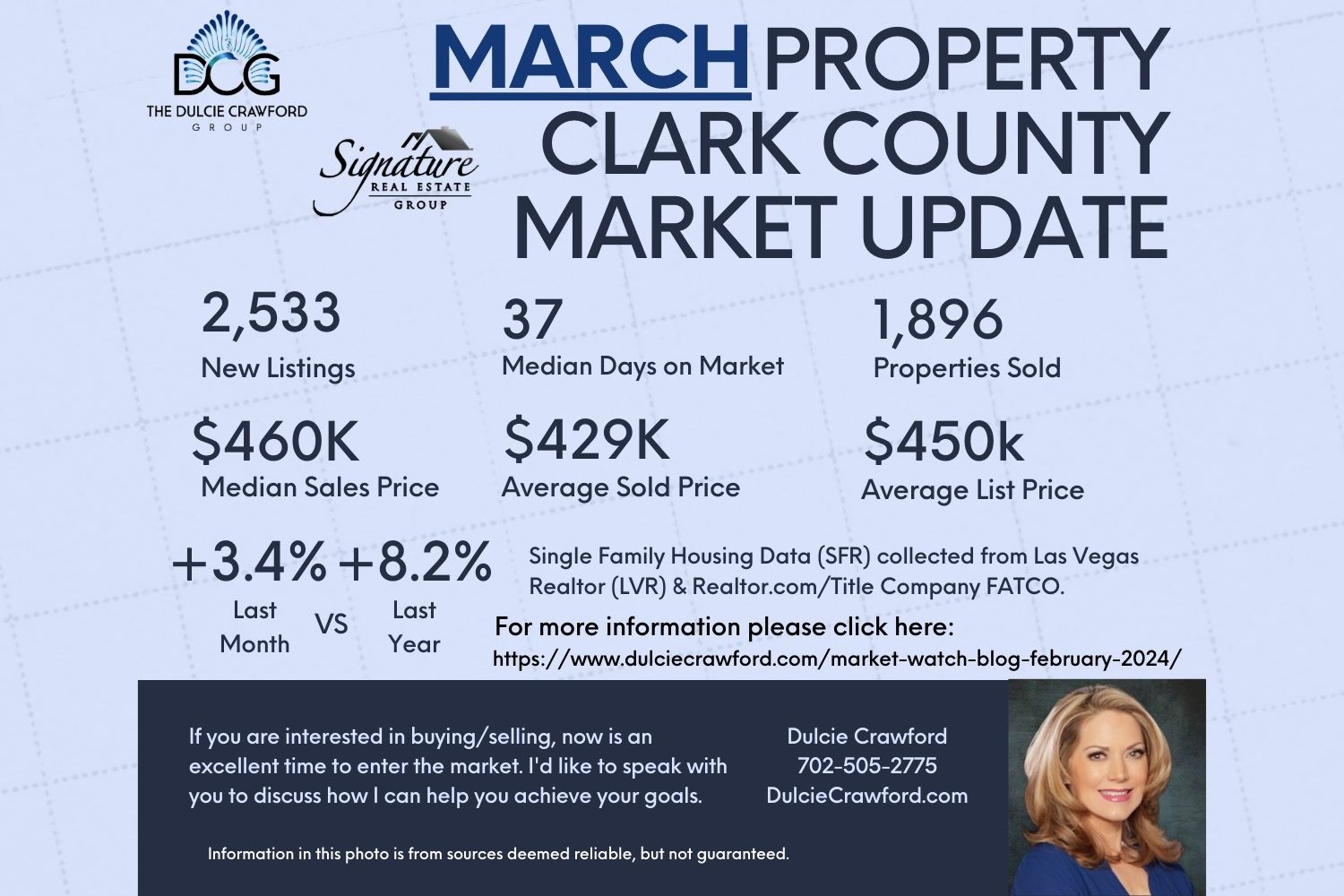

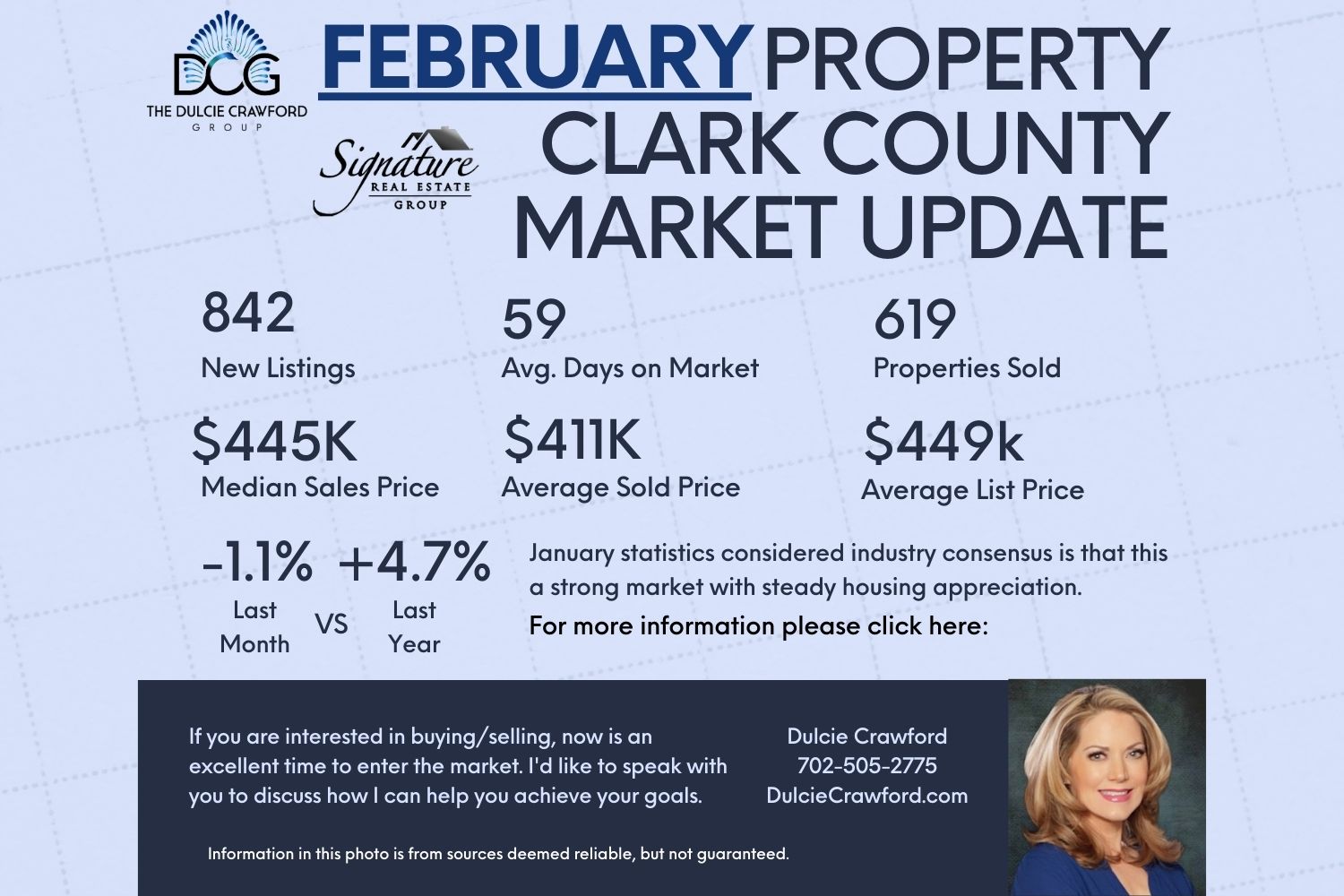

About the Dulcie Crawford Group

If you are interested in purchasing a home and don’t know if you have enough saved, The Dulcie Crawford Group is here to guide you through the entire home-buying process.

A native Las Vegan, Dulcie Crawford has helped hundreds of homebuyers in the Vegas valley find their dream home. Whether you want tips on how to find a lender or advice about Las Vegas neighborhoods, Dulcie is here to assist.

For any questions on buying or selling a home, do not hesitate to call Dulcie at 702.505.2775 or email her at dulciecrawford@gmail.com. To see available properties or more of Dulcie’s community and industry blogs, please visit, newdulcie.agentreputation.net.

Leave A Comment

You must be logged in to post a comment.